International study insurance coverage is a type of insurance that protects individuals who are studying abroad. This type of insurance typically covers medical expenses, trip cancellations, lost or stolen belongings, and other mishaps that may occur while you are studying abroad. This type of insurance when studying abroad is necessary because it can help you cover unexpected expenses and protect you from financial risk. Additionally, many universities and study abroad programs require students to have international study insurance coverage before they allow to participate in their programs.

It’s common knowledge that studying abroad is an educational experience unlike any other. But did you know that in addition to learning about history or culture, you can also learn about insurance? Global health insurance is supplemental coverage covering expenses incurred overseas, especially healthcare-related. It’s different from the range provided by your college or university or your family’s insurance plan. However, it works similarly to both: You pay for it upfront and claim reimbursement later on if necessary.

Table of Contents

ToggleWhat is study abroad insurance?

Study abroad insurance is a type of international health insurance that protects students studying abroad. The idea behind study abroad insurance is that it covers medical expenses and emergency evacuation in case of illness or injury and repatriation costs if you cannot return home for medical reasons.

Studying abroad insurance can help when travelling internationally, but it’s not always necessary. Before buying any policy, make sure you know what kind of benefits your school provides—for example, some schools offer travel scholarships or reimbursements, while others don’t provide any assistance. If you are unsure how much coverage you will need during your time abroad (or whether or not the range is even available), speak with an agent about finding the perfect plan for your needs

Does my study abroad program provide insurance?

While some programs offer some level of coverage, it is usually not comprehensive, and you may have to pay for the rest. If your program provides insurance, ask them what it covers and what is not included. Some programs have an insurance provider they recommend, and this can be helpful if you want to know exactly what kind of coverage you’ll get before buying a policy.

Why do I need study abroad insurance?

It may seem like a no-brainer: Why wouldn’t you get insurance if you’re studying abroad? But the truth is, many students don’t realize the risks of studying abroad and how important it is to be insured. That’s where we come in! We’ll tell you why study abroad insurance is worth the money (probably more than that) and then show you how to buy it.

Why is Study Abroad Insurance Worth It?

How does study abroad insurance work?

First, let’s go over the basics: study abroad insurance is a policy that covers you in the event of illness or injury while you are studying abroad. It can also cover other things like medical treatment at home if you come back early and need care while travelling.

When we say “medical treatment,” we mean precisely anything about your physical health. The costs covered by your insurance may include fees for doctors, hospital stays and surgery, ambulance rides and prescription drugs.

When thinking about this kind of coverage, the main question is, “how much will I have to pay out-of-pocket?” That depends on what type of plan you choose (covered below) and whether or not it includes emergency evacuation services. Generally speaking, most programs will have some cap on what they will reimburse each year, so don’t expect them to pay for everything in full!

Am I covered under my parent's or family's health insurance plan?

If you are over the age of 26, then you may not be covered under your parent’s health insurance plan. This can be a depressing thought considering that many international students are in their 20s, and they’re spending thousands of dollars to study abroad.

However, don’t fret! You can still get coverage—but there are some things to consider first:

- If you’re under 26 years old, you might be able to stay on your parent’s health insurance plan (which is excellent for both of you). For this to happen, however, several conditions must apply:

- You have been continuously enrolled in school since at least the fall term before the study abroad starting date or last day as an eligible dependent until returning home from the study abroad program. If applicable…since turning 25 years old; OR

- Your parent has had employment with an employer who offers group coverage through any type(s) of employer-sponsored health plans since before January 1st, preceding the commencement date until returning home from the study abroad program, AND The employer has provided benefits through their group plan during this period; OR Your parent lose eligibility due solely because they no longer meet eligibility requirements under their employer-sponsored health plan (i.e., pre-existing condition clause), but would otherwise remain eligible if covered by another employer’s group medical plan (i.e., spouse/partner’s company); OR Your parent lose eligibility due solely because they no longer meet eligibility requirements under their employer-sponsored health plan (i.e., take early retirement), but would otherwise remain eligible if covered by another employer’s group medical plan (i.*Please note: All above scenarios must be confirmed with student’s parent/guardian first!

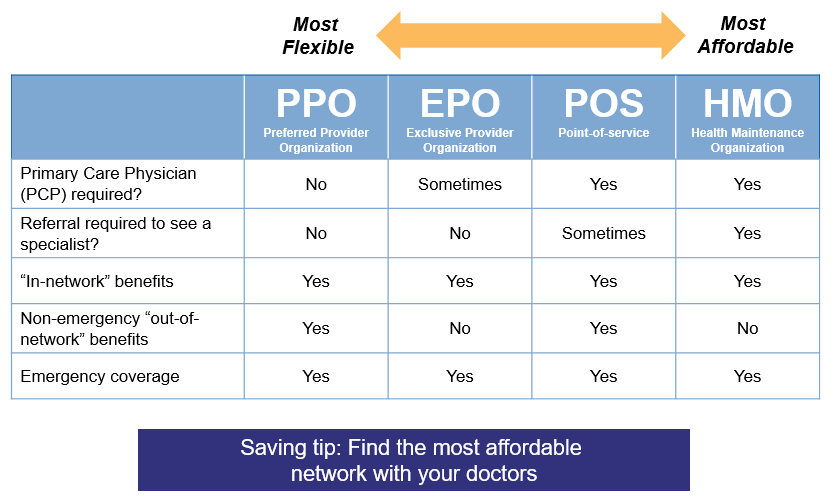

What is the difference between an HMO and a POS?

You may have wondered, what is the difference between an HMO and a POS?

Here’s a quick breakdown:

- HMOs are more restrictive, requiring you to use doctors and hospitals within the network. If you want to go outside the web for any reason, you will be responsible for paying all costs out of pocket.

- POS plans allow you to go outside the network but with a higher cost-sharing scheme (i.e., higher out-of-pocket costs). They also tend to have lower premiums than HMOs because they have less stringent rules regarding who can see patients and where they can receive care.

What is a deductible, and what is full coverage?

What is a deductible?

A deductible is an amount you pay before your insurance company starts to pay. The higher the deductible, the lower your monthly premiums will be. For example, if you have an annual policy with a $1,000 deductible and costs $300 per month (including all fees), then you would have to spend at least $1,000 in medical expenses before your insurance company pays anything for those same services.

You’d only see out-of-pocket costs if they were higher than your monthly premium and deductible. However, many students opt for a low-deductible plan because they want peace of mind knowing that if something bad happens while studying abroad–like getting sick or injured–they are covered from start to finish.*

What does "covered from the very beginning" mean?

Now that you know how to buy travel insurance let’s talk about what it means when you hear “coverage from the very beginning.”

The term “from the very beginning” refers to your coverage starting on the first day of your trip. This means that if an accident happens on day three and you have a $3 million policy, that accident will still be covered by your policy even though, technically, it would not have been covered yet (at least not officially).

By contrast, if something happens on day one but isn’t reported until day 5 or 6—say, for example, you forget to report an injury until after returning home—then it will not be covered under this type of plan because it was not reported within 24 hours of its occurrence. This is important because, in some cases, delayed reporting can prevent coverage from kicking in altogether!

Will I have to pay for health care services in the country where I am studying? Or can I be billed later for any medical expenses incurred domestically after studying abroad for some time?

If you are studying abroad, it is essential to know if you will be responsible for any medical costs incurred in the country you are looking in.

If so, some of your costs may be reimbursed later by your insurance company or through other sources such as scholarships and grants. If not, please consult with your parents/guardians regarding their coverage and options available under their health plan (if applicable).

There are many ins and outs to getting global health insurance as a student.

To begin with, you need to be sure that you are insured against the things students commonly encounter while studying abroad. If your roommate gets food poisoning and has to be hospitalized for three days, you want insurance that covers it. If a friend visits from home and his flight is delayed by several hours, leaving him stuck in an airport with no way to get back home, it’s good if your health insurance covers this.

If you’re unsure about what exactly is covered by most policies or plans (as many people are), here’s where we can help: We developed our own Global Student Health Insurance plan specifically designed with students in mind. It has lots of coverage benefits and options so students can choose their limits on how much they want to be included or excluded from their policies – such as hospitalization/emergency care coverage amount limits per day; lodging/transportation costs incurred while being treated at an out-of-network facility; mental health treatment (including medications); dental care; etcetera.

* Our plan also includes some great extras like travel assistance services like 24/7 emergency response hotline access through MedicAlert Foundation International Inc., which provides the best possible medical support during any emergency, wherever you might be located around the globe!

The bottom line is don’t settle for second best when choosing an international student health insurance plan – instead, take advantage of one tailored to those needs!

Why do international students in Canada need health insurance?

International students in Canada are required to have health insurance to cover the costs of medical treatment while they are in the country. The Canadian government does not provide free healthcare to international students. Hence, they need insurance to cover the costs of any medical treatment they may need while studying in Canada. Health insurance is also required to obtain a student visa to study in Canada

Why do international students in Canada need health insurance?

International students in Canada are required to have health insurance to cover the costs of medical treatment while they are in the country. The Canadian government does not provide free healthcare to international students. Hence, they need insurance to cover the costs of any medical treatment they may need while studying in Canada. Health insurance is also required to obtain a student visa to study in Canada.

Each province in Canada has its health plan.

Yes, that’s correct. Each province in Canada has its own publicly funded health insurance plan, which the provincial government administers. This means that the specific coverage and benefits available to international students may vary depending on the province where they are studying.

It is essential for international students to research the health insurance options available to them in their area and to choose a plan that meets their needs. Some provinces may require international students to enroll in the provincial health insurance plan, while others may allow them to choose from various private insurance options.

Canadian schools might ask to see proof of medical coverage (AKA insurance) when you enroll.

Yes, that’s correct. Canadian schools may ask international students to provide proof of medical insurance when they enroll to ensure they have the coverage they need to pay for any medical treatment they may require while studying in Canada. The Canadian government does not provide free healthcare to international students.

Hence, they need to have insurance to cover the costs of any medical treatment they may need. Health insurance is also required to obtain a student visa to study in Canada. It is essential for international students to research the health insurance options available to them in their province and to choose a plan that meets their needs.

Conclusion

We hope this guide has helped you navigate your study abroad insurance options. If you have any questions about what kinds of plans are available or are interested in exploring other options for international healthcare coverage, please get in touch with us via email or phone. We’ll be happy to answer any questions and help you set up the best plan possible!